A yellow umbrella subscription application is easy to apply to the new umbrella website and call center, and call center, and call center.It is convenient to bring all documents to the business main schedule, and it is convenient to apply to the request for the local governments.Q. To receive a benefit of income deduction system to receive income deduction from yellow umbrella deduction system? The total amount of income deduction for the government.The most limit of yellow umbrella is the most likely to be the most expensive in the public system.◆ period of 30,000 won goods tickets● period: March 1st (Saturday) to September 30, 23rd (Sat) (Saturday) (Saturday) (Saturday)*Application reception date ● Specialist: Online and aid consultants via online and mutual aid consultants channel

[See details of yellow umbrella deduction/Contact for registration ▼]

Q. What is the amount and target of the local government’s desired incentive? You can receive the incentive if you apply to the local government separately within 30 days after applying for a yellow umbrella. Local governments will pay 10,000 to 20,000 won per month for 12 months. When receiving a visit from a mutual aid counselor, you do not need to apply separately and apply at once.Q. What is the interest rate on the yellow umbrella deduction?If a business owner applies for a yellow umbrella, he or she can set a payment premium from 50,000 won to up to 1 million won per month, and the total amount of the payment premium will be subject to an annual compound interest rate of 3.3%.

Q. To apply to other financial zones or banks?If necessary funds are required in the balance of the delivery of the delivery of the delivery money.After applying for yellow umbrella subscription, the company may apply for the delivery of the delivery of the delivery of the delivery of the delivery of the delivery fee.Q. What is the money you delivered to yellow umbrella deduction?If the maintenance of the main umbrella subscription, all delivery of the delivery of the yellow umbrella is excluded from the object.A minimum living expenses can be prepared for the business and exit situation, and the opportunity to restart the business restart.

Q. What kind of welfare services can I receive by subscribing to the yellow umbrella deduction?After applying for a yellow umbrella through a mutual aid counselor, the subscription will be completed once the installment payment is completed. Business accident insurance is provided free of charge for two years, and management consultations such as medical examinations, psychological counseling, and various legal, labor and tax accounts are free. In addition, you can receive various welfare services such as recreational facilities and cultural services. What industries and necessary documents can you sign up for? If you request a visit from a professional mutual aid counselor when applying for a yellow umbrella, you can sign up with only one business registration card and representative ID. There are no restrictions on industries, and it is possible for all small business owners and small business owners who run the business.

The honey TIP & government support project, which meets the yellow umbrella deduction limit and the maximum income tax reduction limit, and the mandatory check yellow umbrella deduction limit for the deduction project fund can be paid up to 1 million won. Payment made when the company subscribes to the yellow umbrella deduction… blog.naver.com

Q. How do I sign up as a freelancer? If you are obliged to report comprehensive consumption tax paid after deduction of 3.3% withholding amount, you can sign up as a freelancer. Freelancer operators can sign up if they can issue business income withholding receipts for two consecutive months.

Q. How do I sign up as a freelancer? If you are obliged to report comprehensive consumption tax paid after deduction of 3.3% withholding amount, you can sign up as a freelancer. Freelancer operators can sign up if they can issue business income withholding receipts for two consecutive months.

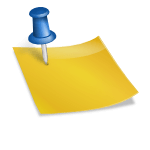

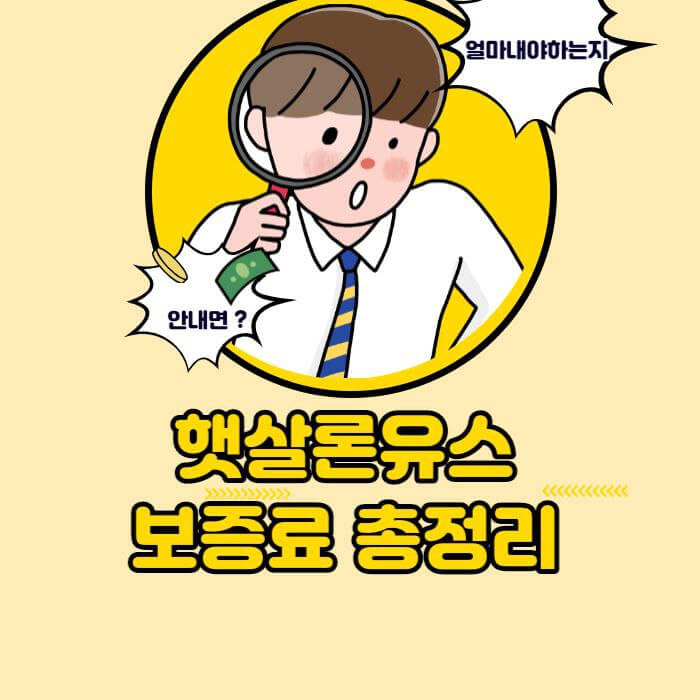

Government Policy Support System to Benefit from Interest on Government-Supported Loans, Small and Medium Enterprises Mutual Aid Fund

The Small Business Mutual Aid Fund is a government mutual aid system established to strengthen financial support for relatively low-credit SMEs, protect them from bankruptcy, revitalize the local economy and help them operate soundly. It operates with government contributions and subscriber payments, and has various benefits in financing.[See the main contents of mutual aid fund / Inquiries about joining ▼]

◐ Full exemption from prepayment fees, full interest expense processing, up to 3 years of repayment period ◐ 100% guarantee of principal even if terminated without bank dependence ◐ 3.25% interest applied to total installment payments at maturity

◐ Maximum guarantees with long-term and short-term operating funds, sufficient business operating funds, working funds, etc. ◐ Apply through non-face-to-face Internet/mobile without documents and remit money immediately

◐ Local governments provide 1-2%p of interest *Limited support when budget is exhausted◐Yellow umbrella deduction subscribers receive interest discount every time

Subscribed industries are targeted at all small and medium-sized business owners and small business owners with business registration cards. Among the industries, the entertainment and gambling sectors are restricted from subscribing, and all other industries can easily sign up by requesting a visit to a mutual aid counselor with just one business registration card.

Short- and long-term operating funds, government and local governments supported “Mutual Aid Fund” vs. income deduction items, yellow umbrella subscription guidance The most effective way for operators to raise short-term operating funds is “Small and medium-sized enterprise mutual aid fund”…blog.naver.comShort- and long-term operating funds, government and local governments supported “Mutual Aid Fund” vs. income deduction items, yellow umbrella subscription guidance The most effective way for operators to raise short-term operating funds is “Small and medium-sized enterprise mutual aid fund”…blog.naver.comShort- and long-term operating funds, government and local governments supported “Mutual Aid Fund” vs. income deduction items, yellow umbrella subscription guidance The most effective way for operators to raise short-term operating funds is “Small and medium-sized enterprise mutual aid fund”…blog.naver.com<Copyright ownerⓒ blog.naver.com/jha409 >Soave – Vendredi [Audio Library Release]Music provided by Audio Library PlusWatch: https://youtu.be/BWbhVQHd2N4Free Download/Stream: https://alplus.io/soave –––––––––––––-